Table of Contents

- What's a Method Mortgage, Anyway?

- Why Consider a Method Mortgage for Your Home Purchase?

- Putting the Method Mortgage into Practice - Initial Steps

- How Does a Method Mortgage Help with Long-Term Planning?

- Who Benefits Most from a Method Mortgage?

- Are There Common Misconceptions About the Method Mortgage?

- Steps to Craft Your Own Method Mortgage Approach

- The Ongoing Perks of a Method Mortgage Mindset

Thinking about getting a home loan can feel like a really big deal, can't it? It's often one of the biggest money moves someone makes in their whole life, and for many, it brings a lot of questions. But what if there was a clear, organized way to go about it, a way that made the whole process feel a little less overwhelming? That's kind of what we're talking about when we mention a "method mortgage." It's about bringing a sense of order to something that might seem quite complicated at first glance, just a little bit.

You see, a method mortgage isn't some secret handshake or a special kind of loan you've never heard of; it's more about how you approach the idea of getting a home loan itself. It's about having a careful, thought-out plan that guides you through each step, making sure you know what's happening and what's coming next. In some respects, it's about being very intentional with your choices, rather than just going with the flow and hoping for the best. It's about having a system, you know?

This organized way of doing things can really make a difference. It can help you feel more in control, and it can help you make better choices for your own situation. It's about applying a sensible, logical set of actions to what might otherwise feel like a confusing financial puzzle. We're going to talk a bit about what this kind of approach means for your home loan experience, and how it can actually make things simpler, basically.

What's a Method Mortgage, Anyway?

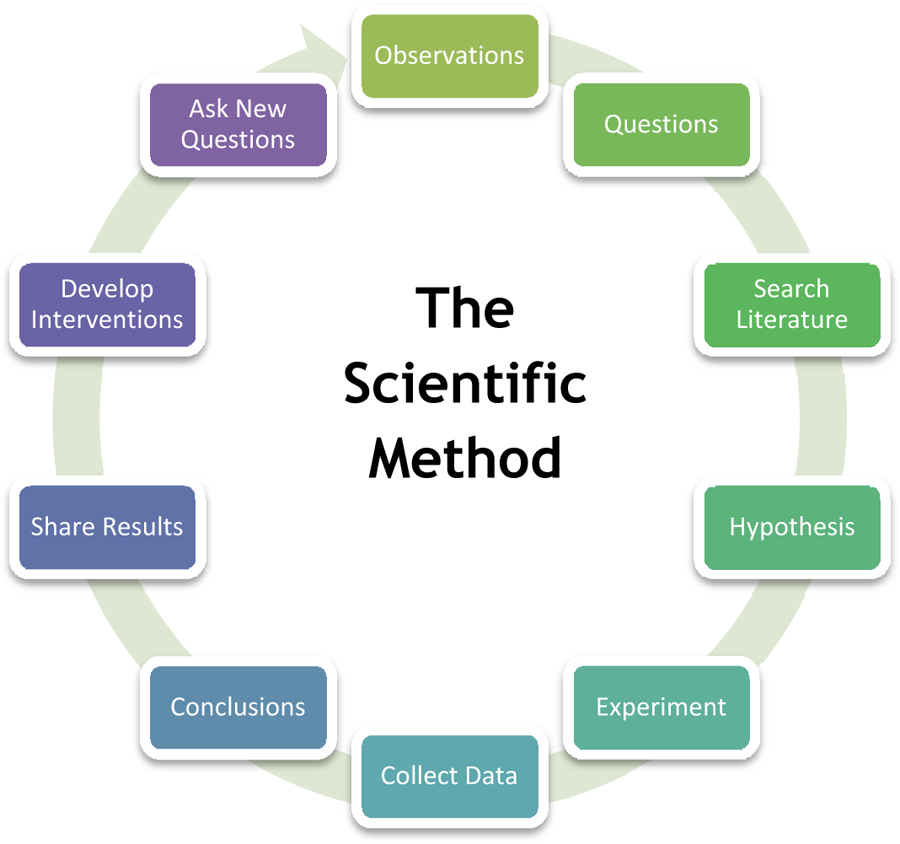

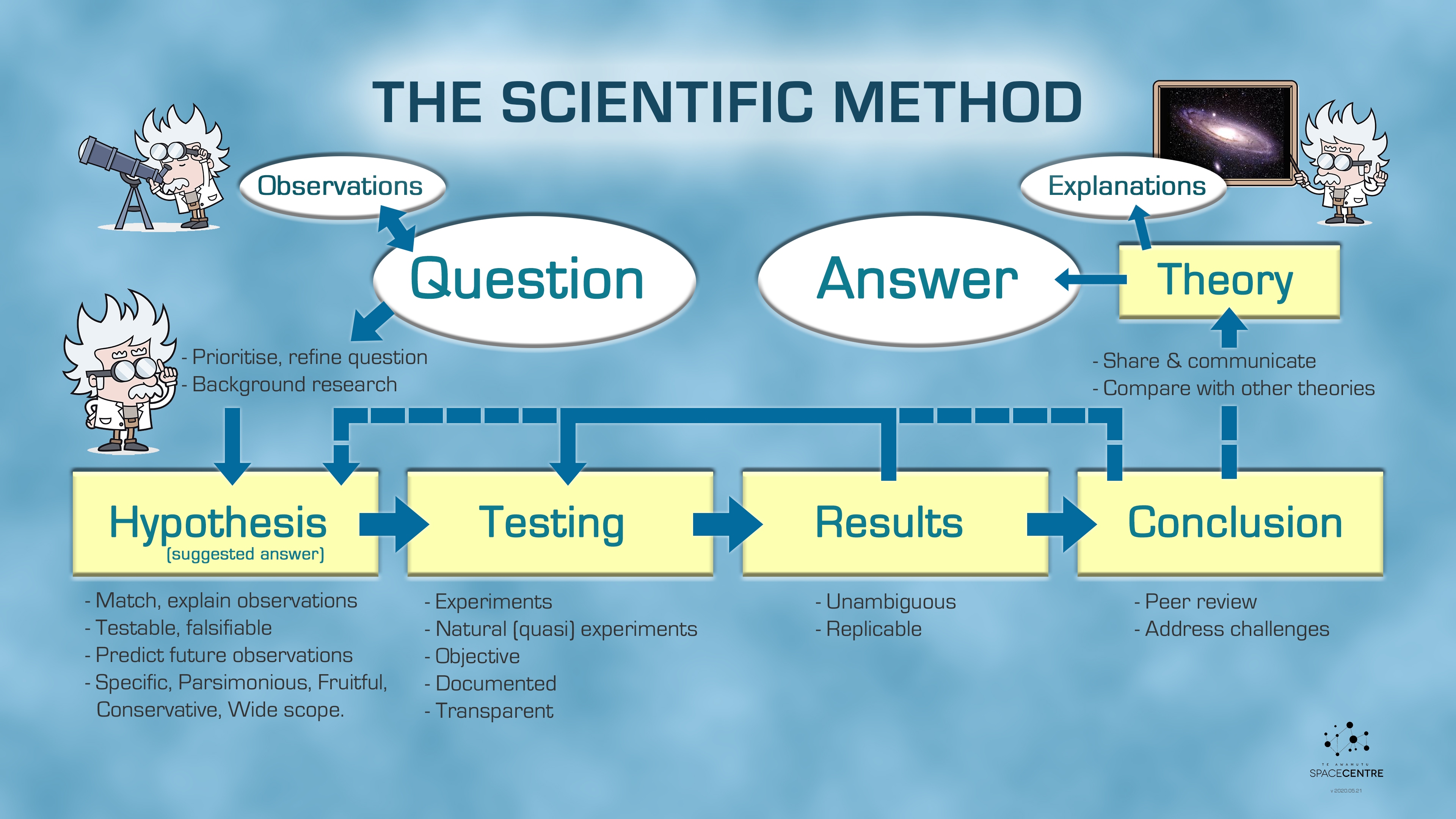

When we talk about a method mortgage, we're really talking about a particular way of handling your home loan. It's not a new product from a bank or anything like that. Instead, it's about having a settled kind of procedure, a very organized set of steps you follow. Think of it like making a really good pie crust, as a matter of fact; there's a simple method for it that just works. This is about bringing that same kind of careful, step-by-step thinking to your home financing. It means you're not just guessing or reacting to things as they come up. Instead, you have a clear idea of the actions you'll take to reach your goal, which is, of course, getting that home loan squared away. It's a systematic, logical process for getting things done, which is pretty neat.

It's about having a definite, established plan, one that helps you move from one point to the next with a clear head. This could mean knowing exactly what papers you need to gather, understanding the different kinds of loans out there, or even figuring out how much you can comfortably afford before you even start looking at houses. It's a means or manner of procedure, especially a regular and systematic way of accomplishing something important, like getting a home. This approach helps you avoid feeling lost or rushed, which can be very helpful when dealing with big money matters. It's about bringing order to what can feel like a busy financial process, you know?

So, a method mortgage is about adopting a structured, systematic approach to your home loan. It’s about having a careful or organized plan that controls the way something is done, rather than just winging it. This kind of thinking helps you see the whole picture, from start to finish. It’s like having a good map for a trip; you know where you’re going and the general stops along the way. This can really take a lot of the guesswork out of things, and that’s a good feeling, isn’t it?

Why Consider a Method Mortgage for Your Home Purchase?

You might be wondering why anyone would bother with such a careful approach for something like a home loan. Well, honestly, it comes down to feeling more in charge and getting better results. When you have a method, a clear way of doing things, you’re much less likely to feel stressed or confused. It’s about having a systematic, logical process that helps you make sense of all the details. This can mean less time spent worrying and more time feeling confident about your choices. It's a way of doing something that helps you keep things straight, basically.

Having a careful or organized plan for your home loan can also help you spot potential bumps in the road before they become big problems. For example, if you know what documents you'll need well in advance, you won't be scrambling at the last minute. This kind of preparation can also help you understand the true costs involved, making sure there are no big surprises later on. It’s about having a settled kind of procedure that helps you anticipate what’s next, which is pretty important when you’re dealing with a large sum of money, you know?

Beyond just avoiding stress, a method mortgage can also help you find a home loan that truly fits your life. When you take the time to organize your thoughts and information, you can compare different options more effectively. This means you might find a loan with better terms or one that saves you money over time, simply because you approached the search in a more structured way. It’s about applying a distinctive technique or approach that can lead to better financial outcomes for you and your family, and that’s certainly a good thing.

Putting the Method Mortgage into Practice - Initial Steps

So, how do you actually start putting this method mortgage idea into action? The very first step often involves getting a clear picture of your current money situation. This means looking at your income, your regular spending, and any money you have saved up. It's about understanding what you're working with, a particular way of doing something that sets the stage for everything else. You can't really plan effectively until you know your starting point, can you?

After that, it's a good idea to figure out how much you can realistically borrow and still feel comfortable with your monthly payments. This isn't just about what a bank might lend you; it's about what feels right for your own budget. This step is part of the orderly logical arrangement, usually in steps, that helps you avoid overextending yourself. It's about making sure your future home doesn't become a source of financial strain, which is a very important consideration, actually.

Another key early action is getting your credit history in good shape. This might mean checking your credit reports for any mistakes or working to pay down some existing debts. Having a good credit standing can make a big difference in the kind of home loan you can get and the interest rate you'll pay. This is a means taken to achieve a better end, a way of doing something that really pays off in the long run. It's a careful or organized plan that controls the way something is done, and it’s a vital piece of the puzzle, truly.

How Does a Method Mortgage Help with Long-Term Planning?

A method mortgage isn't just about getting the loan in the first place; it's also about setting yourself up for success for years to come. Once you have your home loan, this organized approach can help you think about things like making extra payments to pay off your loan faster, or understanding how interest rates might affect you over time. It’s about having a settled kind of procedure that helps you manage your money effectively for the long haul, rather than just focusing on the here and now, you know?

For instance, having a clear method means you're more likely to review your loan terms every so often, perhaps looking for opportunities to refinance if interest rates drop significantly. This kind of systematic, logical process for accomplishing a task helps you stay proactive about your financial well-being. It’s about not just taking out the loan and forgetting about it, but actively managing it as a part of your overall money picture. It’s a way of doing something that can save you a lot of money over many years, too, it's almost.

It also helps you plan for future life changes, like having children, changing jobs, or even retiring. Knowing your home loan situation inside and out, thanks to your methodical approach, allows you to make informed decisions about how these life events might impact your ability to pay. It’s about having a particular way of doing something that gives you peace of mind and flexibility. This means you’re always prepared, which is a very comforting feeling when it comes to big financial commitments, isn't it?

Who Benefits Most from a Method Mortgage?

Honestly, just about anyone thinking about a home loan can get something good out of a method mortgage. But some people might find it especially helpful. If you’re someone who likes things to be orderly and clear, this approach will probably feel very natural to you. It’s about having a systematic, logical process for accomplishing a task, and if you appreciate that kind of structure, you’ll love it. It’s a very sensible way to go about things, you know?

People who feel a bit overwhelmed by all the paperwork and numbers involved in getting a home loan often find a method mortgage to be a huge help. It breaks everything down into smaller, more manageable pieces, making the whole thing seem less scary. It’s about having a careful or organized plan that controls the way something is done, which can turn confusion into clarity. If you've ever felt lost in the details, this kind of approach is definitely for you, too.

Also, if you're someone who wants to make sure you're getting the best possible deal and avoiding any hidden surprises, a method mortgage is a great fit. By following a settled kind of procedure, you’re more likely to ask the right questions and compare options effectively. It’s about having a distinctive technique or approach that empowers you to make truly informed choices. This means you’re not just hoping for the best; you’re actively working towards it, which is pretty smart, right?

Are There Common Misconceptions About the Method Mortgage?

Sometimes, when people hear "method," they might think it means something overly rigid or complicated. But that's not what a method mortgage is about at all. It's not about following a strict rulebook that doesn't allow for any changes. Instead, it's about having a clear framework, a way of doing things that guides you, but still leaves room for flexibility. It’s about having a systematic, logical process that helps you, not traps you. It’s actually quite adaptable, you know?

Another idea people might have is that a method mortgage takes too much time or is only for financial experts. That's simply not the case. While it does involve some initial thought and organization, the time you put in upfront can save you a lot more time and stress later on. It’s about simplifying, not adding complexity. It’s about having a simple method for making your home loan process smoother, kind of like following a recipe that makes cooking easier, rather than harder.

Some might also believe that having a method means you don't need help from professionals. But that's not true either. A method mortgage actually helps you work better with loan officers, real estate agents, and other experts. When you have your own organized approach, you can ask more specific questions and understand their advice more clearly. It’s about having a means or manner of procedure that makes you a more informed participant, which ultimately leads to better conversations and better results. It’s about working together, basically.

Steps to Craft Your Own Method Mortgage Approach

So, how do you go about putting together your very own method mortgage? The first thing is to get really clear on your financial standing. This means looking at your income, your regular spending, and how much you have saved. It’s an orderly logical arrangement, usually in steps, that helps you see your current situation very clearly. You can’t plan where you’re going until you know where you are, can you?

Next, you’ll want to set some realistic goals. How much home can you truly afford? What kind of monthly payment feels comfortable for you? This is a particular way of doing something that helps you avoid overreaching. It’s about finding a sweet spot that works for your life, both now and in the future. This part of the method mortgage helps keep your expectations grounded, which is pretty helpful, actually.

After that, it's a good idea to gather all your important papers. Think pay stubs, bank statements, tax returns, and anything else that shows your money situation. Having these ready is a systematic, logical process for accomplishing a task, and it will save you a lot of time when you’re talking to lenders. It’s about being prepared, which is a really good feeling, you know?

Then, spend some time learning about the different kinds of home loans out there. There are many options, and understanding the basics of each can help you choose the one that fits your needs best. This is a careful or organized plan that controls the way something is done, helping you make an informed choice rather than just picking the first thing you see. It’s about getting a good sense of your choices, which is important.

Once you’ve done your homework, it’s time to talk to a few different lenders. Don't just go with the first one you speak to. Compare what they offer, their interest rates, and any fees involved. This is a settled kind of procedure that helps you find the best deal for your situation. It’s about being thorough, and that can really pay off in the long run, too.

Finally, once you’ve chosen a lender and a loan, stay organized through the application and closing process. Keep copies of everything, and ask questions if anything isn't clear. This is a means or manner of procedure that ensures you stay on top of things right up to the very end. It’s about having a clear path to home ownership, which is the whole point of a method mortgage, isn't it?

The Ongoing Perks of a Method Mortgage Mindset

The good things that come from using a method mortgage don't stop once you've signed the papers and moved into your new place. This organized way of thinking about your home loan can actually stick with you and help you manage your finances over the years. It’s about having a systematic, logical process that becomes a natural part of how you handle your money. This can bring a lot of peace of mind, you know?

For example, having this clear way of doing things means you’ll likely keep an eye on your home's value and the current interest rates. This could lead to smart choices down the line, like refinancing to a lower rate if it makes sense for your budget. It’s about having a careful or organized plan that helps you keep your home loan working for you, not against you. It's a very proactive way to manage things, really.

It also helps you stay on top of your payments and avoid any late fees or missed deadlines. When you have a settled kind of procedure for handling your bills, your home loan payments become just another part of that smooth process. This means less stress and a healthier credit standing, which are both very good things. It’s about having a reliable means or manner of procedure for your financial responsibilities, basically.

Ultimately, a method mortgage mindset helps you feel more confident and in control of one of your biggest financial commitments. It’s about having a particular way of doing something that brings clarity and order to what can sometimes feel like a chaotic process. This kind of organized thinking is a good habit to build for all your money matters, and it’s a way of doing something that really helps you get to where you want to be, isn't it?

- Lotus Building Group

- Julia Shapero

- Ugarte Uruguay

- National Hurricane Center Ernesto

- Tri Land Properties