**In the dynamic world of stock market speculation and investment, platforms like Stocktwits have emerged as crucial hubs for real-time sentiment and discussion. Among the myriad of tickers that capture attention, "ARTW Stocktwits" often surfaces, sparking curiosity about what drives the conversation around this particular stock.** This article will explore the phenomenon of ARTW on Stocktwits, delving into the company behind the ticker, the nature of discussions on the platform, and what investors should consider when evaluating social sentiment for their investment decisions. We aim to provide a comprehensive guide to understanding the buzz surrounding ARTW and how to navigate the often-turbulent waters of social media-driven stock analysis, especially when your money is on the line. The digital age has fundamentally reshaped how information flows in financial markets. Gone are the days when market insights were solely the domain of institutional analysts and expensive terminals. Today, retail investors have unprecedented access to data, news, and, crucially, each other's opinions through platforms like Stocktwits. While this democratization of information offers exciting opportunities, it also presents significant challenges, particularly concerning the reliability and accuracy of shared insights. For a stock like ARTW, which might not always be in the mainstream financial headlines, the Stocktwits community can become a primary source of discussion, making it essential for investors to understand its dynamics. --- **Table of Contents** * [What is ARTW? Understanding Art's-Way Manufacturing Co.](#what-is-artw-understanding-arts-way-manufacturing-co) * [The Role of Stocktwits in Modern Investing](#the-role-of-stocktwits-in-modern-investing) * [Navigating the ARTW Stocktwits Stream: What to Look For](#navigating-the-artw-stocktwits-stream-what-to-look-for) * [Identifying Key Themes and Sentiment](#identifying-key-themes-and-sentiment) * [The Impact of Volume and Mentions](#the-impact-of-volume-and-mentions) * [Analyzing ARTW's Fundamentals: Beyond the Chatter](#analyzing-artws-fundamentals-beyond-the-chatter) * [Technical Analysis on ARTW Stocktwits: Patterns and Price Action](#technical-analysis-on-artw-stocktwits-patterns-and-price-action) * [The Perils and Promises of Social Media Investing](#the-perils-and-promises-of-social-media-investing) * [Recognizing Pump-and-Dump Schemes](#recognizing-pump-and-dump-schemes) * [Separating Signal from Noise](#separating-signal-from-noise) * [Integrating Stocktwits Insights into Your Investment Strategy](#integrating-stocktwits-insights-into-your-investment-strategy) * [A Case Study: ARTW's Journey on Stocktwits](#a-case-study-artws-journey-on-stocktwits) ---

What is ARTW? Understanding Art's-Way Manufacturing Co.

Before diving into the Stocktwits discussions, it's crucial to understand the company behind the ticker: Art's-Way Manufacturing Co., Inc. (ARTW). Headquartered in Armstrong, Iowa, Art's-Way is a small-cap company with a long history, primarily engaged in the manufacturing and distribution of specialized agricultural equipment. Their product lines include sugar beet harvesting equipment, hay and forage equipment, livestock feeding equipment, and land management products. They also have a segment focused on modular buildings. As a relatively small player in a niche market, ARTW typically operates under the radar of major financial news outlets and institutional investors. This characteristic often makes it a subject of particular interest on platforms like Stocktwits. Smaller market capitalization stocks, especially those with limited analyst coverage or lower trading volumes, can be more susceptible to price swings based on news, rumors, or concentrated buying/selling activity. This inherent volatility, combined with its specific industry focus, makes ARTW a compelling ticker for discussions among retail traders and investors seeking overlooked opportunities or potential short-term plays. Understanding the core business of Art's-Way Manufacturing is the first step in deciphering any "ARTW Stocktwits" conversation, as it provides the fundamental context for any financial analysis.The Role of Stocktwits in Modern Investing

Stocktwits has carved out a unique niche as a social media platform specifically designed for investors and traders. Launched in 2008, it quickly became known for pioneering the use of the "$" cashtag (e.g., $ARTW) to identify specific stocks in messages, a convention later adopted by Twitter. Unlike traditional financial news sites that deliver curated articles, Stocktwits operates more like a real-time stream of thoughts, analyses, and reactions from a vast community of participants, ranging from seasoned professionals to novice traders. The platform's primary appeal lies in its immediacy and its ability to gauge collective market sentiment. Users can share charts, technical analysis, news links, and their personal opinions on a stock's future direction. This creates a vibrant, often chaotic, environment where information (and misinformation) spreads rapidly. For stocks like ARTW, which might not have constant coverage from Wall Street analysts, Stocktwits can offer a pulse on what retail investors are thinking and doing. However, it's vital to recognize that Stocktwits is not a substitute for professional financial advice or rigorous due diligence. While it provides a snapshot of crowd sentiment, it also comes with inherent risks. The information shared is often unfiltered, unaudited, and can be driven by speculation, emotion, or even manipulative intent. Understanding these dynamics is crucial for anyone engaging with "ARTW Stocktwits" discussions, as the platform's utility is directly tied to an investor's ability to critically evaluate the content.Navigating the ARTW Stocktwits Stream: What to Look For

When you log onto Stocktwits and search for $ARTW, you're immediately presented with a stream of messages, often referred to as "tweets" or "messages." To effectively utilize this information, you need a discerning eye. It's not about blindly following every post, but rather about identifying patterns, understanding prevailing sentiment, and extracting potentially useful insights that can complement your own research.Identifying Key Themes and Sentiment

The first step in navigating the "ARTW Stocktwits" stream is to identify the dominant themes and the overall sentiment. Are most messages bullish (optimistic about price increase) or bearish (pessimistic about price decrease)? Stocktwits often provides a sentiment indicator based on the "bullish" or "bearish" tags users attach to their posts. While this offers a quick glance, it's more important to read the actual content. Look for recurring keywords or phrases. Are people discussing recent earnings reports, potential new contracts, product developments, or perhaps broader trends in the agricultural sector that might impact ARTW? Are there specific technical levels (support/resistance) that are frequently mentioned? Pay attention to the quality of the arguments presented. Do users provide reasons for their bullish/bearish stance, backed by data, news, or charts, or are they simply expressing hope or fear? A common theme on ARTW Stocktwits might revolve around its low float, potential for short squeezes, or specific news related to its niche agricultural machinery.The Impact of Volume and Mentions

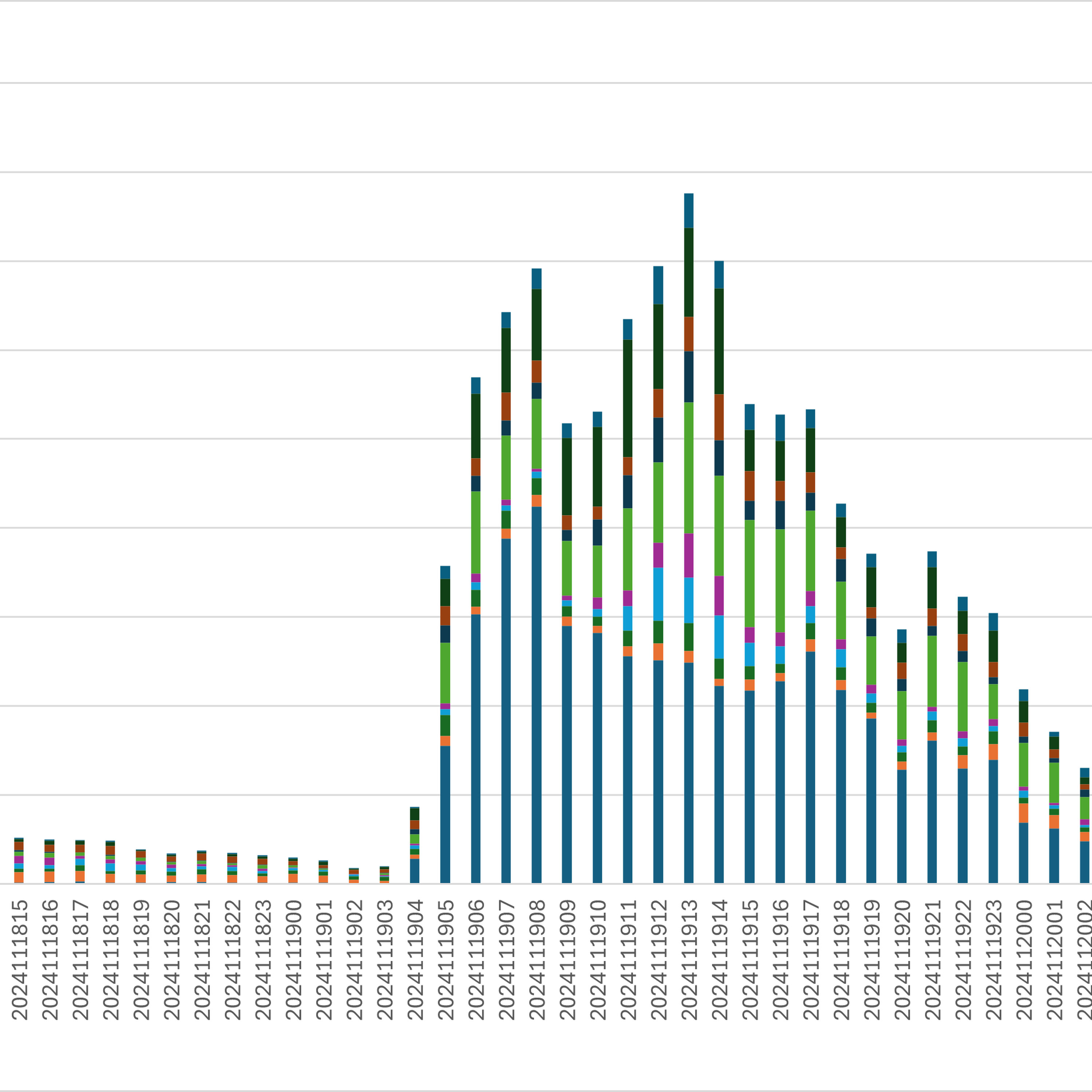

Beyond sentiment, the volume of messages and mentions of $ARTW can be a significant indicator. A sudden spike in the number of posts about ARTW, especially accompanied by an increase in trading volume for the stock itself, often suggests heightened interest. This could be due to breaking news, an earnings release, or simply a surge of speculative interest. For a small-cap stock like ARTW, even a relatively modest increase in Stocktwits activity can precede or coincide with significant price movements. However, caution is paramount. An explosion of mentions, particularly if many posts are vague, overly enthusiastic, or repetitive, can sometimes be a red flag for a "pump" attempt – where individuals try to inflate a stock's price to sell their shares at a profit. Conversely, a lack of discussion might mean the stock is truly off the radar, or it could simply be experiencing a period of low volatility. The key is to correlate Stocktwits activity with actual market data for ARTW and to question the underlying reasons for any sudden surges in discussion.Analyzing ARTW's Fundamentals: Beyond the Chatter

While "ARTW Stocktwits" can offer insights into market sentiment and potential short-term catalysts, it is absolutely critical to look beyond the social media chatter and conduct thorough fundamental analysis. For YMYL (Your Money Your Life) decisions, relying solely on social media is a recipe for disaster. Fundamental analysis involves evaluating a company's financial health, operational efficiency, and overall business prospects. For Art's-Way Manufacturing (ARTW), this would involve examining: * **Revenue Trends:** Is the company growing its sales consistently? Are there seasonal factors due to the agricultural cycle? * **Profitability:** Is ARTW profitable? What are its profit margins? How do they compare to industry peers? * **Balance Sheet Health:** Does the company have manageable debt levels? What are its cash reserves? How strong is its asset base? * **Management Team:** Who is leading the company? Do they have a track record of success? * **Industry Outlook:** What are the broader trends in the agricultural equipment sector? How might factors like commodity prices, farming subsidies, or technological advancements impact ARTW? * **Competitive Landscape:** Who are ARTW's main competitors, and what is its competitive advantage? Information for fundamental analysis can be found in the company's official financial reports (10-K, 10-Q filings) with the Securities and Exchange Commission (SEC), investor relations sections of their website, and reputable financial news sources. These official documents provide verified data, unlike the often speculative nature of Stocktwits posts. A strong fundamental basis provides a crucial anchor against the emotional swings often seen on social media platforms, ensuring that any investment decision in ARTW is based on solid ground, not just fleeting sentiment.Technical Analysis on ARTW Stocktwits: Patterns and Price Action

Technical analysis is another significant component of discussions on "ARTW Stocktwits." Many traders on the platform are focused on price charts, patterns, and indicators to predict future price movements, often with a short-term horizon. While fundamental analysis focuses on the "what" of a company, technical analysis focuses on the "how" – how the stock's price has behaved in the past and what that might imply for the future. On Stocktwits, you'll frequently see users posting charts of ARTW, highlighting various technical elements: * **Support and Resistance Levels:** These are price points where the stock has historically found "support" (bounced up from) or "resistance" (struggled to break above). * **Moving Averages:** Lines on a chart that smooth out price data over a period (e.g., 50-day, 200-day moving averages), often used to identify trends or potential crossovers. * **Volume:** Traders often look for significant volume spikes accompanying price movements, as high volume can confirm the strength of a trend. * **Chart Patterns:** Users might point out patterns like "head and shoulders," "double bottoms," "flags," or "pennants," which some believe can signal future price direction. * **Indicators:** Discussions might involve indicators like RSI (Relative Strength Index) to gauge overbought/oversold conditions, or MACD (Moving Average Convergence Divergence) for trend following. While technical analysis can be a useful tool for timing entries and exits, especially for short-term traders, it's important to remember that it's based on historical price action and is not a guaranteed predictor of future performance. For ARTW, a low-volume stock, technical patterns can sometimes be less reliable or more easily manipulated. It's crucial to understand the principles of technical analysis yourself rather than blindly following someone else's chart interpretation on Stocktwits. Combine technical insights with fundamental understanding to make more informed decisions.The Perils and Promises of Social Media Investing

Social media platforms like Stocktwits offer both exciting opportunities and significant dangers for investors, particularly when it comes to smaller, less liquid stocks like ARTW. The promise lies in the democratization of information and the potential to uncover overlooked opportunities or gain real-time insights into market sentiment. The peril, however, is the prevalence of misinformation, manipulative tactics, and the emotional contagion that can lead to poor investment decisions. This is where the YMYL (Your Money Your Life) principle becomes acutely relevant.Recognizing Pump-and-Dump Schemes

One of the most significant risks on platforms like Stocktwits is the "pump-and-dump" scheme. This involves individuals or groups artificially inflating the price of a stock (the "pump") through misleading or exaggerated statements on social media, only to sell their own shares at the inflated price (the "dump"), leaving unsuspecting investors with significant losses. Small-cap stocks with low trading volumes, such as ARTW, are particularly vulnerable to these schemes because it takes less capital to significantly move their price. Warning signs of a pump-and-dump on "ARTW Stocktwits" might include: * **Excessive Hype:** Posts filled with exclamation marks, emojis, and unrealistic price targets ("ARTW to the moon!"). * **Lack of Substance:** Messages that lack any fundamental or technical basis, relying purely on emotional appeals or vague "insider information." * **Repetitive Messaging:** The same or very similar messages being posted repeatedly by different accounts. * **New Accounts:** A sudden influx of new accounts promoting the stock. * **Urgency:** Calls to buy "now or never" or to "not miss out." Always be skeptical of posts that sound too good to be true. If you encounter such patterns related to ARTW, it's best to step back and conduct your own independent, unbiased research.Separating Signal from Noise

Beyond outright manipulation, a significant challenge on Stocktwits is simply separating valuable "signal" (actionable, reliable information) from "noise" (speculation, opinions, or irrelevant chatter). This requires developing critical thinking skills and a disciplined approach. To improve your signal-to-noise ratio when looking at ARTW Stocktwits: * **Follow Credible Users:** Identify users who consistently provide well-reasoned analyses, share verifiable data, and have a track record of accurate insights. Many users on Stocktwits build reputations for their expertise. * **Verify Information:** Never take information at face value. If someone mentions a news item or a specific financial metric, cross-reference it with official company releases (e.g., SEC filings) or reputable financial news sources (e.g., Bloomberg, Reuters, Wall Street Journal). * **Look for Diverse Opinions:** Don't just consume posts that confirm your existing bias. Actively seek out both bullish and bearish arguments to get a balanced perspective. * **Understand the Context:** A post might be relevant at one moment but outdated quickly. Consider the time a message was posted and what market conditions were like then. Ultimately, your ability to filter information and make independent judgments is your best defense against the pitfalls of social media investing.Integrating Stocktwits Insights into Your Investment Strategy

Given its nature, Stocktwits should be viewed as a supplementary tool in your investment arsenal, not a primary source of truth, especially for critical "Your Money Your Life" decisions. For ARTW, or any stock, integrating Stocktwits insights into your strategy means using it intelligently and cautiously. Here’s how you can approach it: 1. **Sentiment Indicator:** Use Stocktwits to gauge the prevailing mood around ARTW. Is the crowd overwhelmingly bullish or bearish? Contrarian investors might look for opportunities when sentiment is overly negative, while trend followers might align with strong positive sentiment. 2. **Idea Generation:** Stocktwits can sometimes highlight stocks or themes that you might not have encountered through traditional news channels. A sudden surge in "ARTW Stocktwits" activity might prompt you to investigate the company further. 3. **Real-Time News and Reactions:** While not always the first to break news, Stocktwits can provide immediate reactions to news events concerning ARTW, offering a glimpse into how the retail investor community is interpreting developments. 4. **Technical Confirmation:** If you're already performing your own technical analysis on ARTW, Stocktwits can show you if others are seeing similar patterns or levels, potentially confirming your own observations. 5. **Risk Management:** Be acutely aware that social media sentiment can shift rapidly. Never commit a significant portion of your capital to a trade based solely on Stocktwits chatter. Always define your entry and exit points, and use stop-losses to protect your capital. The most effective strategy involves combining insights from Stocktwits with rigorous fundamental analysis (understanding ARTW's business, financials, and industry) and sound technical analysis (interpreting its price action). This multi-faceted approach provides a more robust framework for making investment decisions, mitigating the risks associated with relying too heavily on any single source of information, especially a social one.A Case Study: ARTW's Journey on Stocktwits

While specific real-time data for ARTW's Stocktwits journey would require live monitoring, we can construct a general case study based on typical patterns observed for small-cap stocks on the platform. Imagine a scenario where ARTW, a relatively quiet stock, experiences a sudden surge in mentions on Stocktwits. **Phase 1: The Initial Spark.** Perhaps Art's-Way Manufacturing announces a new product line, secures a significant contract, or releases better-than-expected quarterly earnings. A few astute traders on Stocktwits, having done their fundamental research, pick up on this news. They post initial "bullish" messages, sharing charts showing a potential technical breakout from a long consolidation period. The initial "ARTW Stocktwits" posts are data-driven and analytical. **Phase 2: Growing Momentum.** As the stock price begins to tick up, more traders notice. Volume on Stocktwits for $ARTW increases. More charts are shared, highlighting support levels and potential targets. Some users, perhaps those with larger followings, start mentioning ARTW, attracting more eyeballs. The sentiment becomes overwhelmingly bullish, and the conversation shifts from pure analysis to more speculative price targets. This is where the line between genuine interest and hype can blur. **Phase 3: Peak Hype and Potential Overextension.** At this stage, the "ARTW Stocktwits" stream becomes a torrent of messages. New users, drawn in by the rapid price appreciation, jump on board. Messages become less about fundamentals or technicals and more about "to the moon" rhetoric. This is often the point where pump-and-dump artists might try to capitalize, spreading unsubstantiated rumors or overly optimistic predictions. Trading volume for ARTW itself might spike dramatically, but the price action could become parabolic and unsustainable. **Phase 4: The Pullback and Reassessment.** Eventually, the initial momentum wanes. Early investors or those who recognize the unsustainable nature of the rally begin to take profits. The stock price of ARTW starts to pull back. The Stocktwits stream for $ARTW might then see a mix of panic, denial, and some users attempting to rationalize the pullback. This phase highlights the rapid shifts in sentiment and the often-painful reality check for those who bought purely based on hype. This hypothetical journey underscores the cyclical nature of social media-driven interest in stocks. It demonstrates that while Stocktwits can be an early indicator of interest or a source of real-time discussion, it also requires a disciplined approach to discern genuine opportunities from speculative bubbles. For ARTW, understanding its niche market and financial stability is always paramount, regardless of the social media buzz. --- **Conclusion** Navigating the world of "ARTW Stocktwits" requires a balanced perspective and a disciplined approach. While platforms like Stocktwits offer an unparalleled window into real-time market sentiment and can be a source of early ideas or technical confirmations, they are also rife with speculation, misinformation, and emotional trading. For a stock like Art's-Way Manufacturing (ARTW), which operates in a specific niche and may not receive extensive traditional media coverage, the social buzz can feel particularly influential. However, remember that your investment decisions are "Your Money, Your Life." Never base your investment strategy solely on what you read on social media. Always prioritize thorough fundamental analysis of ARTW's business, financial health, and industry outlook. Combine this with your own technical analysis, and use Stocktwits as a supplementary tool to gauge sentiment and identify potential catalysts, rather than a definitive source of truth. By exercising caution, critical thinking, and independent verification, you can leverage the power of the crowd while safeguarding your financial well-being. What are your thoughts on using social media for investment insights? Have you found valuable information on Stocktwits, or have you encountered its pitfalls? Share your experiences in the comments below, and consider exploring other articles on our site for more in-depth investment guides and market analysis. Always remember: do your own research, and if in doubt, consult a qualified financial advisor.- Is Hep B More Contagious Than Hiv

- Optima Automotive

- Darien Car Clinic Car Wash

- Taylor Fritz League Of Legends

- Julia Shapero