The world of business credit cards is vast, but few cards capture the imagination of entrepreneurs and seasoned business owners quite like the American Express Business Platinum Card. And when the whispers of a "300k Amex Biz Platinum" offer surface, it's enough to make even the most stoic financial strategists sit up and take notice. This isn't just about earning points; it's about transforming your everyday business expenses into unparalleled travel, operational savings, and exclusive experiences that can genuinely elevate your enterprise.

For any business, managing cash flow and maximizing every dollar spent is paramount. The Amex Business Platinum card, particularly with a lucrative welcome bonus, stands as a powerful tool in this endeavor. It promises not just rewards, but a suite of premium benefits designed to support and streamline your business operations, from travel logistics to software subscriptions. This guide will delve deep into the card's offerings, how to strategically leverage it, and whether a potential 300,000-point bonus truly makes it the cornerstone of your business's financial toolkit.

Table of Contents

- Decoding the Amex Business Platinum Card: A Foundation for Growth

- The Allure of a 300,000-Point Welcome Offer (and What It Means)

- Maximizing Your Membership Rewards: Beyond the Welcome Bonus

- Unpacking the Amex Business Platinum Benefits for Business Owners

- Navigating Retention Offers and Long-Term Value

- Strategic Card Holdings: Amex Biz Platinum vs. Other Cards

- Common Pitfalls and How to Avoid Them with Your Amex Business Platinum

- Is the Amex Biz Platinum 300K Offer Right for Your Business?

Decoding the Amex Business Platinum Card: A Foundation for Growth

At its core, the American Express Business Platinum Card is designed for established businesses with significant spending, particularly in areas like travel and large purchases. It's not just a credit card; it's a comprehensive benefits package aimed at enhancing business efficiency and providing substantial value back to the cardholder. The card carries a substantial annual fee, currently $695 (rates & fees may apply), which often gives pause to potential applicants. However, for the right business, the value derived from its benefits and the immense earning potential, especially from a "300k Amex Biz Platinum" welcome offer, can easily offset this cost.

This card targets businesses that frequently incur expenses in areas such as airfare, hotel stays, shipping, and technology. Its value proposition lies in its premium travel perks, a range of statement credits, and accelerated earning on specific categories. Understanding who this card is for is the first step in determining if it aligns with your business's financial strategy.

The Allure of a 300,000-Point Welcome Offer (and What It Means)

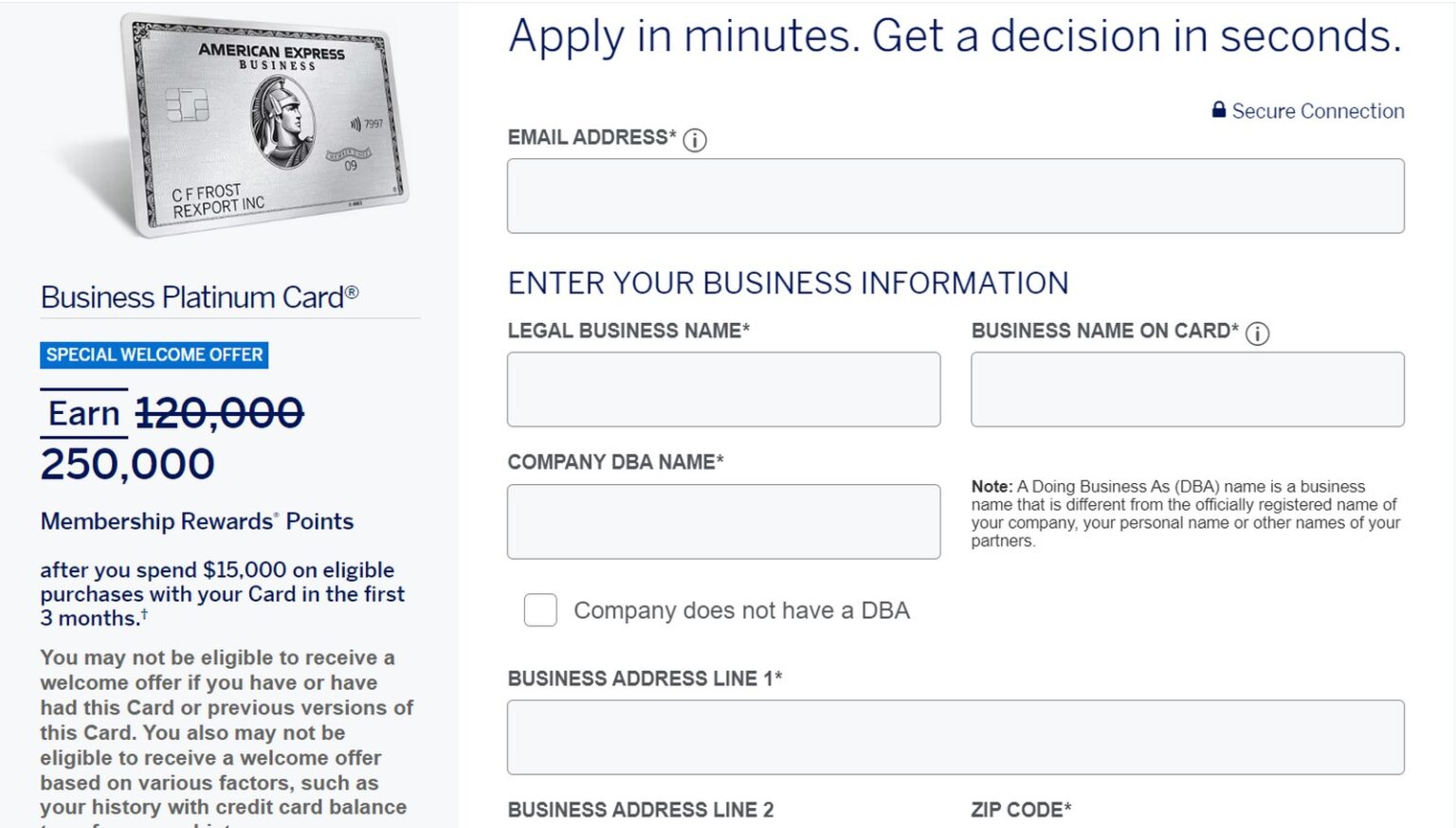

The prospect of a "300k Amex Biz Platinum" welcome offer is, quite simply, massive. While typical public offers might hover around 100,000 to 150,000 Membership Rewards (MR) points, a 300,000-point bonus represents an exceptional opportunity to inject a significant amount of value into your business's rewards portfolio from the outset. Such high offers are usually targeted or appear during specific promotional periods, often requiring a substantial spending threshold to be met within a limited timeframe.

For context, consider a more common offer like "Amex platinum spend $4,000 over next 90 days for 50,000 MR points." While a decent start, scaling that up to 300,000 points would logically imply a much higher spend requirement. Historically, offers of this magnitude might demand spending $15,000, $20,000, or even $30,000 within the first few months. This is where businesses with significant operational expenses truly shine. As one cardholder noted, they had "Already spent 15,000 on it," highlighting the kind of expenditure necessary to unlock these top-tier bonuses.

- Angel Cat Haven

- Iqst Investorshub

- Pride Is Not The Opposite Of Shame But Its Source

- Kia Of Portland Broadway

- Grease Bags Shark Tank Net Worth

Meeting these spend requirements necessitates careful planning. It's crucial to ensure that your business's organic spending aligns with the required threshold, rather than forcing unnecessary purchases. Always "Continue reading into the second paragraph of the terms" of any offer. This is vital because the exact timing of transactions can impact whether they count towards the bonus. For instance, "if an eligible purchase is made on December 31st but the merchant processes the transaction such that it is" posted in the new year, it might not count for the previous period's requirement. Understanding these nuances is key to successfully securing your 300,000-point bonus.

Maximizing Your Membership Rewards: Beyond the Welcome Bonus

While a "300k Amex Biz Platinum" welcome bonus is a fantastic start, the true long-term value of the Business Platinum card lies in its ongoing earning potential and the versatility of Membership Rewards points. The card offers several ways to earn points on your everyday business spending:

- 5X Membership Rewards points on flights and prepaid hotels booked on AmexTravel.com.

- 1.5X Membership Rewards points on eligible purchases of $5,000 or more (up to 1 million additional points per calendar year). This is a significant perk for businesses making large equipment purchases, software investments, or paying substantial invoices.

- 1X Membership Rewards point on all other eligible purchases.

Monitoring your points is straightforward, but sometimes there can be a delay in posting. As one user mentioned, "My last update was on January 8 and I have made many purchases since then and normally those miles post." While points usually post promptly, it's always wise to keep an eye on your activity and reconcile it against your statements. This proactive approach ensures you're earning every point you're entitled to.

Once accumulated, Membership Rewards points are incredibly flexible. They can be transferred to a variety of airline and hotel loyalty programs, often at a 1:1 ratio, unlocking premium travel experiences. They can also be used for statement credits, gift cards, or booking travel directly through Amex Travel, though transferring to partners typically yields the highest value.

Unpacking the Amex Business Platinum Benefits for Business Owners

Beyond the points, the Amex Business Platinum card is packed with benefits designed to add tangible value to your business. These perks are often what justify the high annual fee for many cardholders.

Travel Credits and Lounge Access

For businesses that involve frequent travel, the card's travel benefits are unparalleled:

- Airport Lounge Access: Access to the Global Lounge Collection, including Centurion Lounges, Priority Pass Select, Delta Sky Clubs (when flying Delta), and more. This alone can save significant money on food, drinks, and workspace at airports.

- Airline Fee Credit: Up to $200 in statement credits annually for incidental fees on your selected qualifying airline. A common question arises about its usage: "Or does our airline selection carry over to the next year?" Typically, the airline selection is annual and must be re-selected or confirmed each year. Another common query is "Just wondering if I can make a travel bank purchase right on 1/1 or will need to wait a day after." While some credits reset on January 1st, it's often prudent to wait a day or two for the new calendar year to officially register in Amex's system before making purchases intended to trigger new credits.

- Hotel Status: Complimentary Gold status with Marriott Bonvoy and Hilton Honors, offering perks like room upgrades, late checkout, and bonus points. One specific perk mentioned is the "Quarterly $50 statement credit for stays with Hilton," which adds up to $200 annually, further offsetting the annual fee.

- Global Entry or TSA PreCheck Credit: A statement credit for the application fee for Global Entry or TSA PreCheck.

Business-Specific Statement Credits

The card also offers a range of credits tailored to business needs:

- Dell Technologies Credit: Up to $400 in statement credits annually for U.S. purchases with Dell ($200 semi-annually). This is incredibly useful for businesses needing new laptops, monitors, or other tech accessories.

- Indeed Credit: Up to $360 in statement credits annually for Indeed products and services ($90 quarterly).

- Adobe Credit: Up to $150 in statement credits annually for eligible Adobe subscriptions.

- Wireless Credit: Up to $120 in statement credits annually for eligible wireless telephone services ($10 monthly).

These credits, when fully utilized, can significantly reduce your business's operational costs, making the annual fee far more palatable.

Elite Status and Other Perks

Beyond the credits, the card offers other valuable benefits:

- Fine Hotels + Resorts Program: Access to exclusive benefits like daily breakfast for two, room upgrades, and a unique amenity (e.g., a $100 food and beverage credit) at participating luxury hotels.

- Car Rental Privileges: Elite status with car rental programs like Hertz Gold Plus Rewards President's Circle, Avis Preferred, and National Car Rental Emerald Club Executive.

- Purchase Protection and Extended Warranty: Added peace of mind for business purchases.

Navigating Retention Offers and Long-Term Value

For many cardholders, the initial welcome bonus, like a "300k Amex Biz Platinum" offer, is the primary draw. However, the high annual fee often leads to a dilemma in subsequent years: keep the card or cancel it? This is where retention offers come into play. A retention offer is a bonus (points or statement credit) that a credit card issuer provides to incentivize you to keep your card open when you express an intention to cancel.

As one cardholder shared, they got the card "in September of 2022, and this is the first time I've called for a retention offer." This illustrates a common strategy: wait until the annual fee posts, then call Amex to inquire about retention offers. Sometimes, "the initial agent had to transfer me to a different representative to give the offer," indicating that not all customer service representatives are authorized to provide these. Persistence and politeness are key.

The value of a retention offer, combined with the ongoing utilization of the card's credits and benefits, helps determine if the card remains valuable year after year. If you consistently use the Dell, Indeed, Adobe, wireless, and airline credits, the effective annual fee can drop significantly. However, if you find yourself struggling to use the credits or feel "annoyingly, the current price for" the annual fee outweighs the benefits you actually use, it might be time to re-evaluate.

Strategic Card Holdings: Amex Biz Platinum vs. Other Cards

Many business owners don't just hold one credit card; they curate a portfolio. A common consideration is whether to hold the Amex Business Platinum alongside other cards, especially other Amex cards. For example, one user mentioned, "I currently hold the BA Amex Premium Card." They are "considering switching" due to the "attractive welcome bonus on the new Amex Platinum card," but wonder, "Is it unwise to retain the BA Amex while also getting the Platinum?"

This is a crucial strategic question. Holding both the Business Platinum and another card like the BA Amex Premium (which earns Avios) can make sense if your spending patterns align with both. The Business Platinum excels in travel perks and large purchases, while airline-specific cards offer benefits tailored to that airline and their loyalty program. It's not necessarily unwise; it depends on your travel habits and how you value different loyalty currencies.

Often, the Business Platinum complements other Amex cards that earn Membership Rewards, such as the Amex Gold or Green cards, or even the personal Platinum card. Points earned across different MR-earning cards pool together, allowing you to accumulate a larger balance faster. For example, using an Amex Gold for dining and groceries (4X MR points) and the Business Platinum for flights and large business purchases creates a powerful earning ecosystem.

Common Pitfalls and How to Avoid Them with Your Amex Business Platinum

While the Amex Business Platinum offers immense value, it's not without its potential traps. Being aware of these can help you maximize your benefits and avoid costly mistakes:

- Not Meeting the Welcome Bonus Spend: The most common pitfall. Failing to meet the required spending within the specified timeframe means missing out on the lucrative "300k Amex Biz Platinum" bonus. Plan your spending carefully and track it meticulously.

- Misunderstanding Credits: The various statement credits have specific rules and expiration dates. Not all purchases with Dell or Hilton, for example, will trigger the credit. Always read the terms for each credit to ensure you're making eligible purchases. Forgetting to select your airline for the annual credit is another common oversight.

- Annual Fee Shock: If you don't fully utilize the card's benefits and credits, the $695 annual fee can feel like a heavy burden. Regularly assess whether the value you derive from the card outweighs its cost.

- Redemption Pitfalls: While Membership Rewards points are flexible, not all redemption options offer equal value. Using points for statement credits or merchandise often yields a poor return compared to transferring them to airline or hotel partners for premium travel. Understand the best ways to redeem your points before cashing them in.

- Overspending: Never spend more than your business can afford simply to meet a bonus requirement or chase points. Credit card rewards should supplement, not dictate, your financial decisions.

Is the Amex Biz Platinum 300K Offer Right for Your Business?

The American Express Business Platinum Card, especially when coupled with an extraordinary "300k Amex Biz Platinum" welcome offer, presents an incredible opportunity for businesses. However, its suitability hinges on several factors:

- Your Business Spending: Do you have significant, consistent business expenses, particularly in areas like travel, large purchases ($5,000+), Dell products, or digital advertising? If your business naturally incurs high costs, meeting the bonus spend and maximizing ongoing earning will be easier.

- Your Travel Habits: Do you or your employees travel frequently? The lounge access, airline credits, and hotel status can provide substantial comfort and savings.

- Your Ability to Utilize Credits: Are you confident you can consistently use the various statement credits (Dell, Indeed, Adobe, wireless, airline, Hilton)? If you can consistently extract value from these, the effective annual fee drops considerably.

- Your Financial Discipline: Can you manage a high-annual-fee card responsibly, avoiding debt and ensuring you meet all terms and conditions for bonuses and benefits?

For a business that aligns with these criteria, the Amex Business Platinum card, particularly with a 300,000-point head start, can be a game-changer. It's more than just a payment tool; it's a strategic asset that can unlock premium experiences, reduce operational costs, and streamline your business's financial operations.

Conclusion

The allure of a "300k Amex Biz Platinum" offer is undeniable, representing a significant boost to any business's rewards strategy. The American Express Business Platinum Card stands as a powerful testament to premium business rewards, offering a robust suite of benefits from unparalleled travel perks to valuable statement credits that directly impact your bottom line. It's a card designed for growth-oriented businesses that understand the value of leveraging every expense into an advantage.

As we've explored, maximizing this card requires a clear understanding of its terms, a strategic approach to spending, and a commitment to utilizing its extensive benefits. From meeting the initial spend requirement to navigating retention offers and strategically combining it with other cards, every step contributes to unlocking its full potential. If your business is poised for growth and has the spending patterns to match, the Amex Business Platinum could be the key to unlocking extraordinary value and elevating your operations.

What are your thoughts on high-value business card offers? Have you successfully leveraged a "300k Amex Biz Platinum" bonus or a similar offer for your business? Share your experiences and insights in the comments below, or explore our other articles on maximizing business credit card rewards to continue your journey towards financial savvy!